A Little Peek Into Our Thoughts On Money

- Written by Lindsey Huster

- /

- 4 min read

- /

- Last updated 7 months ago

I think we all struggle with wanting more money. We *think* this equates to success or happiness or contentment. I feel like we’ve always had a pretty realistic view of money, but we have also changed our thinking toward money in the last few years. This isn’t to say we are right or that we don’t still have moments of wanting more, but I feel like we understand the value of money better than ever before.

How do you have money to travel so much?

I get this question pretty often. It’s really not any different than how anyone else has money for certain things. We just choose to put the majority of our disposable income towards travel. By basically being debt-free and choosing to save for travel, we have a rather large “vacation” budget. It’s been a combination of calculated decisions that have gotten us to this point.

Gallery of Keith and Lexi working remotely from our motorhome

We are fortunate that Keith has a great career as a software engineer

In all honesty, Keith earns a great salary as a software engineer. He also spent over two years working a full-time job and doing a significant amount of contract work at the same time. This was really difficult on him and both of us, but we are reaping the benefits now.

I was a teacher for 14 years and left that position when we moved over three years ago. I now work off and on for our local school district as a tester and substitute teacher. We’ve both had professional jobs that have equated to money as well as financial and health benefits.

I know it’s a lot easier to change your thinking toward money when you have these advantages. I also know a little bit about the flip side. Several years ago, my husband died suddenly and I could barely live on my beginning teacher salary. My position was cut several years in a row and each summer I didn’t know if I would have a job in the fall. Thankfully, it always worked out that I did get reinstated otherwise I would have lost health insurance and most likely my home. At the time, I literally counted every penny I earned and spent. This experience has not been forgotten and still impacts the way I view money.

We live within our means

Keith and I have always lived within our means, as individuals before we met and together as a couple. We’ve always saved first, for emergencies or for things we’ve needed/wanted. We know that if we don’t have the extra money to spend, we don’t buy it. Stress about money can work the other way too. At times we can stress about needing to spend money, but not wanting to give up the security of having it saved.

Making more money vs buying less stuff

This is such a simple concept, but yet I don’t think most think this way. It took some time, but now this is our overall view of money. Does that mean we don’t buy stuff? No, but it does change what we choose to buy. Keith and I choose to buy things that allow us to DO stuff. We bought a motorhome, a jeep, new ski equipment, hiking gear, etc. because those items give us the opportunity to experience activities we’re interested in. We choose to buy fewer clothes, kitchen gadgets, and other things that mainly serve to fill our house.

Calculate your spending

Since I make so little now and my income is mainly for my personal items, I tend to calculate by how much time it takes me to work to buy that item. When I realize I have to work a day to buy a shirt or a pair of shoes I tend to choose to have that day off and enjoy myself much more than a certain item… of course, there are times I actually need something. If you know me, you know many of my clothes have stains and/or holes. 😉 However, rather than shopping, I would rather have time to myself! Sometimes spending is a choice and you can choose not to spend.

Money can work for you

We try to find ways that money can work for us. For example, we switched credit card companies (we do put all purchases on a card for the reward points) and banks because the member perks were better. We’ve also bought a rental property that in the future will provide us with a steady revenue stream. We sell items we don’t use when we replace them with a newer model. Using coupons or websites can also save us money. Finding ways for other “income” or for savings no matter how small adds up.

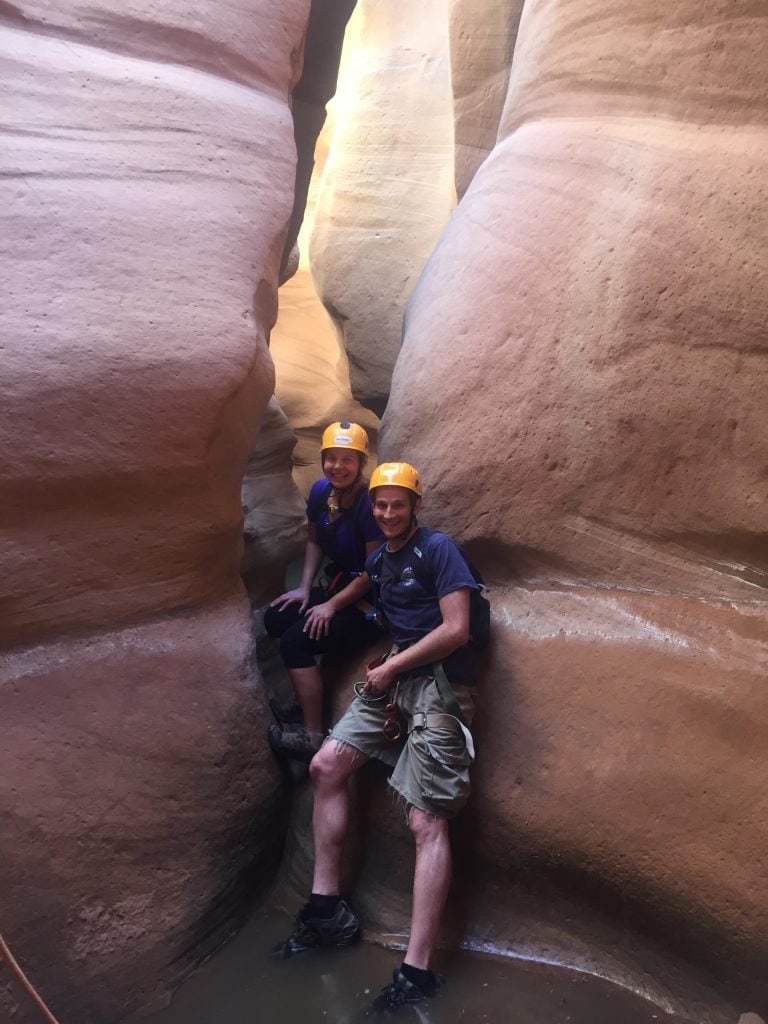

Gallery of us enjoying outdoor adventures thanks to our financial freedom

Have you ever changed your thoughts toward money?

Have you had a life event or major change in thinking about money? Is there a specific tip you’d like to share on how you save money? Share with us in the comments below.